Why use a PayPal fee calculator? Today, almost every online purchase – whether in various e‑shops, on eBay Classifieds, on eBay ,

Amazon, etc. – can be paid with PayPal. This payment system ensures that transactions are processed faster, easier, and more securely. Unlike paying with a credit or debit card, you don’t need to enter your card details

every time you use PayPal; you provide them just once when setting up your account. As a private individual, you incur no fees when buying or selling with PayPal. Fees only apply when you use a credit card to pay or send

money internationally. However, if you sell products as a merchant to private buyers, fees are charged upon receiving payment. A closer look at PayPal’s fee structure reveals how complex these charges can be. Trying to

figure out PayPal fees in your head for every transaction is usually time‑consuming and inaccurate. With our free paypal fee calculator for the US (United States) market, you can easily estimate PayPal fees and always stay on top of your PayPal costs.

Different Terms for PayPal Fees & Charges

Many people look for a “PayPal commission calculator,” “PayPal cost calculator,”

“PayPal service fee calculator,” or “PayPal service charge calculator.” All these

terms mean basically the same thing: a quick way to figure out how much you’ll

pay in PayPal fees.

The PayPal Fee Calculator

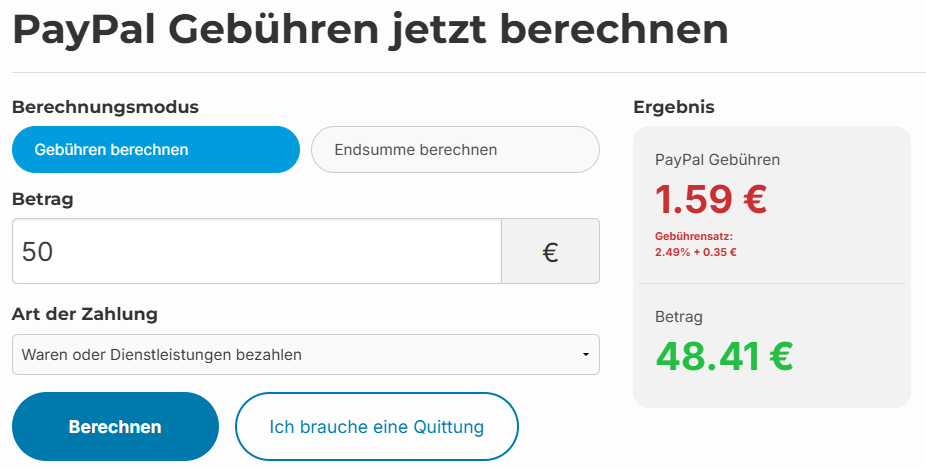

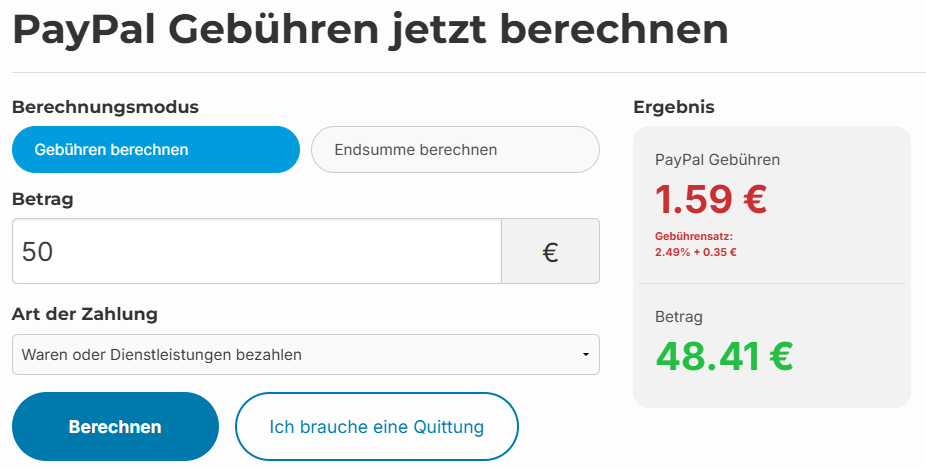

As a seller, it can be quite challenging to calculate PayPal fees on the fly—numerous exceptions and special conditions based on seller type, price, category, listing format, and quantity make it complicated. Our free fee calculator for PayPal is designed to help you manage your fees during your next PayPal transaction. The tool is very simple to use: all you need to enter is the amount you want to receive and select the type of payment.

Before you calculate your fees, you must choose one of the following payment types:

- Pay for goods or services

- Payment to friends and family (personal)

- Collect donations

- Micropayment

- Checkout via PayPal

After entering your data, the results field will show you the fees charged as well as the net amount you’ll receive. To illustrate, we have provided two brief calculation examples below.

How it works: Simply choose whether you want to calculate the amount that PayPal deducts from the total or the fees to be added. Then enter the amount and the payment type – that’s it.

How it works: Simply choose whether you want to calculate the amount that PayPal deducts from the total or the fees to be added. Then enter the amount and the payment type – that’s it.

Example Calculations

Calculation Example 1:

If, as a merchant, you want to receive $150 for goods or services, PayPal will charge fees of approximately $4.49. The net amount you receive will be around $145.51.

Calculation Example 2:

If you use the PayPal Checkout and want to receive $150, PayPal’s fee will be roughly $5.73, leaving you with a net amount of about $144.28.

Receiving Payments – Understanding PayPal Fees

Once you receive money from a customer for goods or services, a fee is applied. The fee amount depends on the payment type.

-

Pay for goods or services: When a customer pays for a product or service and you receive money, a fee (which includes coverage for buyer protection) of approximately 2.49% of the sale price plus $0.35

is charged.

-

Payment to friends and family: Within the US, sending money to friends and family is typically free. However, if a credit card is used, additional credit card fees may apply.

-

Collect donations: When using the PayPal donation button on your website, a fee of around 1.5% of the donation plus $0.35 is charged.

-

Micropayment: For receiving very small amounts, PayPal offers a micropayment solution. In this case, you pay about 10% of the amount plus $0.10.

-

Merchant rates (for transactions between $5,001 and $25,000): If you are a merchant earning between $5,001 and $25,000, you can opt for individual merchant rates. In such cases, the fee might be around

1.99% plus $0.35 per transaction.

-

Merchant rates (for transactions over $25,000): For merchants with annual transactions over $25,000, you may qualify for a further reduction to approximately 1.79% of the sale price plus $0.35.

-

Payment via QR Code: When paying via QR Code, a fee of about 0.90% of the amount is charged. For transactions under $10, an additional fixed fee of $0.05 applies.

To learn more about PayPal fees, click here.

Paypal Fee Overview

When you sell products or services via PayPal and receive payments from customers, fees are applied. The fee amount depends on the type of transaction – below you’ll find a clear table outlining all possible costs for commercial transactions in the United

States. We’ve also compiled further detailed information in our Fee Overview.

| Transaction Type |

Domestic Fee |

| Alternative Payment Method (APM) |

APM rates apply |

| PayPal Checkout |

3.49% + fixed fee |

| PayPal Guest Checkout |

3.49% + fixed fee |

| QR Code Transactions |

2.29% + fixed fee |

| QR Code Transactions via Third-Party Integrator |

2.29% + $0.09 |

| Pay with Venmo |

3.49% + fixed fee |

| Send/Receive Money for Goods and Services |

2.99% |

| Standard Credit and Debit Card Payments |

2.99% + fixed fee |

| PayPal Pay Later Options |

4.99% + fixed fee |

| All Other Commercial Transactions |

3.49% + fixed fee |

International Transactions

For international transactions, the domestic fee is applied plus an additional 1.50%. For example, if the domestic rate is 3.49%, the international rate becomes 4.99% plus the fixed fee.

How it works: Simply choose whether you want to calculate the amount that PayPal deducts from the total or the fees to be added. Then enter the amount and the payment type – that’s it.

How it works: Simply choose whether you want to calculate the amount that PayPal deducts from the total or the fees to be added. Then enter the amount and the payment type – that’s it.